http://www.cbc.ca/news/business/oil-price-decline-could-lead-to-global-shocks-don-pittis-1.2852597

ANALYSIS

Oil price decline could lead to global shocks: Don Pittis

How low can oil go? Historically the industry has seen boom and bust

By Don Pittis, CBC News Posted: Nov 28, 2014 5:00 AM ET Last Updated: Nov 28, 2014 8:23 AM ET

If you think falling oil prices are not going to have a big effect on industry or on the rest of us, that's not what history tell us, Don Pittis writes.

If you think falling oil prices are not going to have a big effect on industry or on the rest of us, that's not what history tell us, Don Pittis writes.

Oil price plunging

Oil price plunging 2:48

1024 shares

Facebook

Twitter

Reddit

Google

Share

Email

About The Author

Photo of Don Pittis

Don Pittis

The Business Unit

Don Pittis has been a Fuller Brush man, a forest fire fighter and an Arctic ranger before discovering journalism. He was principal business reporter for Radio Television Hong Kong before the handover to China and has produced and reported for CBC and BBC News. He is currently senior producer at CBC's business unit.

Related Stories

Paul Davis says province will weather oil-price crush

Oil price falls below $70 US as OPEC leaves output unchanged

Questions about $75 oil hang over Alberta's latest fiscal update

Loonie oil prices could fall much further: Don Pittis

Amaranth hedge fund estimates losses at $6B US

External Links

Oil price fall starts to weigh on banks

Oil price slide leaves energy bond investors facing zero returns

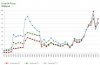

A graph of oil price volatility since 1970

(Note: CBC does not endorse and is not responsible for the content of external links.)

It is easy to forget that oil has always been a boom and bust business.

As we watched oil prices tumble over the last four months, from over $100 US to $90 to $80, I was repeatedly surprised by glib comments from people in the oil industry who said the decline would not have a significant effect on business.

Perhaps it's the optimism inherent in the rootin' tootin' resource sector. Maybe it's just that in the oil business, memories are short.

Because if you think falling oil prices are not going to have a big effect on industry or on the rest of us, well, that's not what history tell us. And I'm not talking about ancient history, although that may apply too. I'm talking about my own lifetime.

Oil price falls below $70 US as OPEC leaves output unchanged

Oil price falls to $74 US before OPEC meeting

I remember the first time around in university, investing my tuition in Norcen Energy and making a killing before dunning notices from Lakehead U. forced me to sell.

hi-arctic-oil-rig-greeland

An Arctic oil rig operates off Greenland. This is not the first time Canada has seen an exploration boom in the Far North.

I remember a few years later, around 1980, working with Panarctic Oils during a frenzy of drilling in the high Arctic islands. After all, the world was hungry for gas to pump down the soon-to-be-constructed Mackenzie Valley Pipeline.

A friend from the North who had gone to Calgary to work for an oil company bought the largest house he could afford. That was the advice everyone was giving. With the oil boom on, house prices could only rise.

Rude surprise

But suddenly, in the mid-'80s it seemed the world had changed in an instant. In a matter of months oil prices had started to plunge and the plunge became a rout.

Calgary house prices began to fall. Even successful oil and gas strikes were capped. Norcen Energy disappeared. So did Panarctic Oils, its huge base on Melville Island's Rae Point mothballed. Talk of a gas pipeline faded.

I have no evidence to prove that the same thing is happening now, but before you reject the idea altogether it might be wise to look at a historic graph of oil prices.

Keystone Construction Defects

TransCanada's Keystone XL pipeline has been a controversial project. In the 1980s, the Mackenzie Valley pipeline was a similar flashpoint. (Tony Gutierrez/Associated Press file photo)

The bizarre thing that shocked everyone in the 1980s was how suddenly the market turned. In retrospect it feels as if people in the industry should have known. Surely if they had they would have done things differently. My friend in Calgary would have bought a more modest house.

Happening again?

This time around, just before yesterday's decision by OPEC not to cut output, everyone seemed to think that the OPEC decision had already been priced into the market. After all, oil prices had already tumbled from over $105 US four months earlier to $75 US.

Not so. Minutes after the organization's secretary general Abdalla El-Badri said, "We're going to produce 30 [million barrels a day] for the first half of the year," leaving production unchanged, oil prices started falling again.

West Texas Intermediate, the North American benchmark price, tumbled another four dollars into the $69 US range.

Of course, what everyone is wondering now is how much further it has to fall.

News stories now imply that the decline was obvious. Growing production and falling demand mean there is a glut. But the surprising thing is not how much has changed since June when oil was selling at $105 US a barrel, but how little.

It reminds me of the more recent example of natural gas in 2006 when investors in hedge fund Amaranth lost their shirts as the price of gas plummeted in a matter of months.

Natural gas price hits 7-year low

Amaranth losses at $6 billion US

With access to so much information in the form of big data, it is hard to say why we are constantly surprised by sudden extreme price changes — in that case from more than $10 per thousand cubic feet to less than $3 — and why we don't do something to mitigate the extremes.

On the other hand, it was amusing to see commentators in the notoriously free-market oil industry regretting the failure of OPEC to manipulate prices. "OPEC just declared war on everyone — including itself," said the pro free market Wall Street Journal.

As I have pointed out many times in the past, the free market can be a harsh mistress.

And it is not just oil investors who will feel the pinch if prices continue to decline. Already there have been reports of banks and bonds hurting because of the fall in oil prices.

Governments from Venezuela to Alberta are losing tax revenue and could well lose more. Lower oil prices will make it harder for green energy projects to compete. Greenhouse gases could rise as people burn fuel more freely. Calgary house prices could fall.

Now that oil prices have started falling, it is impossible to know where they will stop. Certainly in the past they have fallen far below where they are now. On the other hand, if we are using history as our guide, no matter how far they fall, one day oil prices will rise again.