Copied from current insurance with Western Financial.

Insurance is provided only for coverages for which a specific amount of insurance is stated herein

Deductible Amount of Insurance Premium

Hull & Machinery $ 576 $ 57,600 Included

Main Engine $ 576 $ Included Included

Electronic Navigational Equipment $ 250 Included Included

Trailer $ 250 $ 3,500 Included

Personal Effects Insurance $ 250 $ 5,000 Included

Breakdown Towing/Commercial Assistance $ 50 $ 2,500 Included

Loss of Use and Additional Living Expenses 24 Hours $ 5,000 Included

Protection & Indemnity Insurance

NIL

$ 2,000,000

Included

Uninsured and Underinsured Boater Protection

NIL

$ 2,000,000

Included

Medical Payments Insurance NIL $ 5,000.00 ANY ONE PERSON / $25,000.00 Included ANY ONE ACCIDENT OR OCCURRENCE

Accidental Death Benefit NIL $ 10,000 per Death Included

Pet Companion Benefit NIL $ 1,000 in total Included

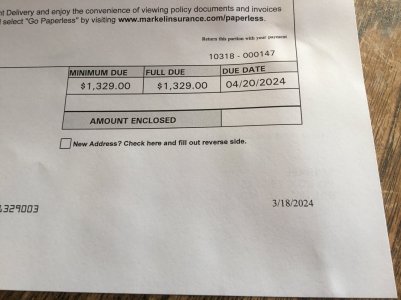

TOTAL PREMIUM

This was $721 in 2022.

$745 in 2023

$767 this year.