ab1752

Crew Member

LTE.V just took off

Haha...I've been holding the bag on that thing for years, I think my acb us like 2 bucks.

LTE.V just took off

Well that's a different perspective on it.Haha...I've been holding the bag on that thing for years, I think my acb us like 2 bucks.

I’m still calling it CenturyLink! That is a solid dividend. Wonder how long that will be sustainable. Just a reminder US stock dividends are taxed at 15% I believe.LUMN:us a very cheap stock with great div. sold off this am on earnings write down of good will, this is an awesome buy and hold here for anyone looking for that. I bought it this am and also bought arx, I really like this deal with vii, not a bad div either.

they aren't taxed in an rrsp, I keep all my us div stocks in my rrsp for that reason.I’m still calling it CenturyLink! That is a solid dividend. Wonder how long that will be sustainable. Just a reminder US stock dividends are taxed at 15% I believe.

BVS seems to be the better IPO so farBMBL just went live

RBC won't let me buy it.BVS seems to be the better IPO so far

RBC won't let me buy it.

I hate it. Switched to Questrade but it takes up to 20 days to transfer the account. I should have just funded it with clients money right away lol.RBC's back office is slow AF in my experience.

yeah, was about to say...time to get a real broker! Questrade is great. Maybe its a delay these days but I thought I got transfer in 4-5 days when I moved my RRSP. Yeah, i would have just funded fresh and then move over.I hate it. Switched to Questrade but it takes up to 20 days to transfer the account. I should have just funded it with clients money right away lol.

That's pretty impressive. I'm usually pretty happy with 20%.So far my top stocks are:

EH up 138% MVIS up 226% FD up 125% and down $17 right now from Monday. It has exceeded my 20 percent loss rule, but I haven't sold it yet, but if it drops again tomorrow I will. BLINK has to be more than 200% for me but I have sold and bought back in several times, which I have also done with PLUG and FUEL and ROKU which currently up 81% Other stocks I have been in and out of are APPS and LSPD. With the latter stocks I have been trading the highs and lows, but I am switching to more of a buy and hold program, which is why I have hesitated on selling FD. I would normally have sold it by now, and would buy it back in after three days of positive trading, often buying back in about where I sold it, thus the switch in style. We will see it makes a difference.

Yep me too! Wood Gundy got me 17% on my safe stuff last year. ........my account........ still in recovery from the weed stocks 2 years ago. Almost back to even.That's pretty impressive. I'm usually pretty happy with 20%.

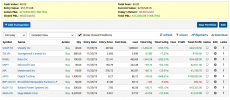

As I said, previously I would trade in and out, so I never really knew what my gains were. I kept planning to set up a spread sheet and track my trades. then about 15 months ago I started using barchart and entered the stocks I held at that time and left it alone, barchart tracks what they would have been worth if I didn't F*%& with them, I realized I was missing out bigly. These are the stocks I owned Nov 2019. My portfolio is not worth this much today, I wish it was. But it's a valuable lessonThat's pretty impressive. I'm usually pretty happy with 20%.

So far my top stocks are:

EH up 138% MVIS up 226% FD up 125% and down $17 right now from Monday. It has exceeded my 20 percent loss rule, but I haven't sold it yet, but if it drops again tomorrow I will. BLINK has to be more than 200% for me but I have sold and bought back in several times, which I have also done with PLUG and FUEL and ROKU which currently up 81% Other stocks I have been in and out of are APPS and LSPD. With the latter stocks I have been trading the highs and lows, but I am switching to more of a buy and hold program, which is why I have hesitated on selling FD. I would normally have sold it by now, and would buy it back in after three days of positive trading, often buying back in about where I sold it, thus the switch in style. We will see it makes a difference.