I have a Gemini Pro account and it gave me this

Recreational Boats Can Enjoy Tariff-Free Travel Under USMCA: Here's How

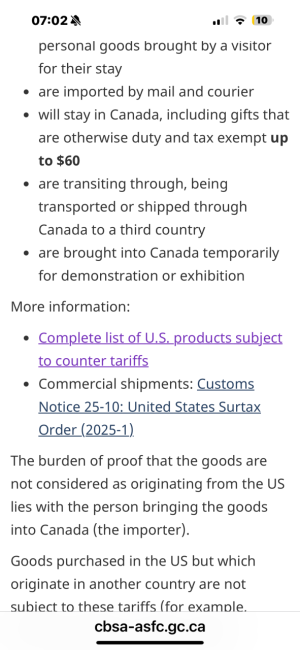

Recreational boats manufactured in the United States, Mexico, or Canada can be exempt from tariffs when traded between the three countries, provided they meet the specific "rules of origin" outlined in the United States-Mexico-Canada Agreement (USMCA). The agreement, which replaced NAFTA, eliminates tariffs on most qualifying goods, including recreational vessels, fostering a more integrated North American market.

The key to this exemption lies not in a blanket immunity for all boats, but in adherence to the detailed provisions within the USMCA's text, primarily in Chapter 2: National Treatment and Market Access for Goods and Chapter 4: Rules of Origin.

The Foundation for Tariff Exemption

Article 2.4 of the USMCA, titled "Elimination of Customs Duties," serves as the foundational provision for tariff-free trade. This article stipulates that no party shall increase any existing customs duty or adopt any new customs duty on an "originating good." For a recreational boat to be considered an "originating good" and thus benefit from this exemption, it must comply with the criteria set forth in Chapter 4.

Meeting the "Rules of Origin"

A recreational boat's eligibility for tariff exemption hinges on proving it "originates" from within the USMCA trade bloc. This is primarily determined in one of two ways: a "tariff shift" or by meeting a "regional value content" requirement.

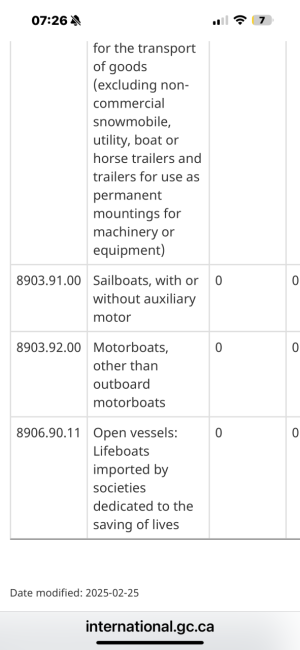

1. Tariff Shift (TS): This is the most common method for many manufactured goods. A tariff shift occurs when the final product (the boat) has a different tariff classification under the Harmonized System (HS) than its non-originating components. The HS code for most recreational boats and yachts falls under Chapter 89. The specific rule of origin for a particular boat will dictate how much transformation the non-North American parts must undergo. If all the non-originating materials used in the production of the boat are in a different HS chapter than the final boat, it will likely qualify.

2. Regional Value Content (RVC): If a boat's components share the same HS classification as the final product, it can still qualify for tariff exemption by meeting a minimum Regional Value Content. This means a certain percentage of the boat's value must be attributable to North American parts and labor. The USMCA provides two methods for calculating RVC:

* Transaction Value Method: This method is based on the price of the good. The formula is:

RVC = \frac{TV - VNM}{TV} \times 100

where TV is the transaction value of the good and VNM is the value of non-originating materials. For most goods, the required RVC under this method is 60%.

* Net Cost Method: This method is based on the total cost of the good minus costs for sales promotion, marketing, after-sales service, and other specified expenses. The formula is:

RVC = \frac{NC - VNM}{NC} \times 100

where NC is the net cost of the good. The required RVC under this method is typically 50%.

The choice of which RVC method to use generally lies with the producer, exporter, or importer.

The Crucial "Certification of Origin"

To claim the tariff exemption, the importer must have a "certification of origin." This is not a standardized form like the previous NAFTA Certificate of Origin. Instead, it is a set of nine minimum data elements that can be included on an invoice or any other commercial document. These elements are:

* Certifier Information: Name, address, and contact information of the person certifying origin.

* Exporter Information: Name, address, and contact information if different from the certifier.

* Producer Information: Name, address, and contact information if different from the certifier or exporter.

* Importer Information: Name, address, and contact information.

* Description and HS Tariff Classification of the Good: A detailed description of the recreational boat and its six-digit HS code.

* Origin Criterion: The specific rule of origin under which the boat qualifies (e.g., tariff shift or regional value content).

* Blanket Period: If the certification covers multiple shipments of identical goods, the period (up to 12 months) it covers.

* Authorized Signature and Date: The signature of the person certifying the origin.

* Certification Statement: A statement affirming that the goods described qualify as originating and the information is true and accurate.

This certification can be completed by the exporter, producer, or, in some cases, the importer. It is crucial for the party issuing the certification to maintain records to support the claim of origin.

In conclusion, while the USMCA provides a clear pathway for tariff-free trade in recreational boats, it is essential for manufacturers, exporters, and importers to understand and comply with the specific rules of origin and documentation requirements. By ensuring a boat qualifies as "originating" and providing a valid certification of origin, the benefits of this North American trade agreement can be fully realized.